(1) | (1)The grant date shown is the date on which the Compensation Committee approved the target awards. (2) Threshold and maximum awards are based on the provisions in the VCIP. Actual awards earned can range from 0 to 200% of the target awards, with a further possible adjustment of +/–50% of the target award depending on individual performance. The Compensation Committee retains the authority to make awards under the program and to use its judgment in adjusting awards, including making awards greater than the amounts shown in the table above, provided the award does not exceed amounts permitted under the 2013 Omnibus Stock and Performance Incentive Plan of Phillips 66. Actual payouts under the annual bonus program for 2020 are calculated using base salary earned in 2020 and reflected in the "Non-Equity Incentive Plan Compensation" column of the SUMMARY COMPENSATION TABLE. (3) Threshold and maximum awards are based on the provisions of the PSP. Actual awards earned range from 0 to 200% of the target. Performance periods under the PSP cover a three-year period, and because a new three-year period commences each year, there could be three overlapping performance periods ongoing. In 2020, targets were set with respect to an award for the performance period beginning in 2020 and ending in 2022. The Compensation Committee retains authority to make awards under the PSP using its judgment, including making awards greater than the maximum payout shown in the table above, provided the award does not exceed amounts permitted under the 2013 Omnibus Stock and Performance Incentive Plan of Phillips 66. (4) RSUs were granted in 2020 and will vest in 2023. | PHILLIPS 66 PROXY STATEMENT 2021 53 |

(2) | Threshold and maximum awards are based on the provisions in the VCIP. Actual awards earned can range from 0 to 200% of the target awards, with a further possible adjustment of +/–50% of the target award depending on individual performance. The Compensation Committee retains the authority to make awards under the program and to use its judgment in adjusting awards, including making awards greater than the amounts shown in the table above, provided the award does not exceed amounts permitted under the 2013 Omnibus Stock and Performance Incentive Plan of Phillips 66. Actual payouts under the annual bonus program for 2019 are calculated using base salary earned in 2019 and reflected in the“Non-Equity Incentive Plan Compensation” column of theSUMMARY COMPENSATION TABLE.

|

(3) | Threshold and maximum awards are based on the provisions of the PSP. Actual awards earned can range from 0 to 200% of the target awards. Performance periods under the PSP cover a three-year period, and since a new three-year period commences each year, there could be three overlapping performance periods ongoing at any time. In 2019, targets for each NEO were set with respect to an award for the three-year performance period beginning in 2019 and ending in 2021. The Compensation Committee retains the authority to make awards under the PSP using its judgment, including making awards greater than the maximum payout shown in the table above, provided the award does not exceed amounts permitted under the 2013 Omnibus Stock and Performance Incentive Plan of Phillips 66.

|

(4) | RSUs were granted in 2019 and will vest in 2022.

|

(5) | For equity incentive plan awards, these amounts represent the grant date fair value at target level under the PSP as determined in accordance with GAAP. For Stock Option awards, these amounts represent the grant date fair value of the option awards using a Black-Scholes-Merton-based methodology. Actual value realized upon option exercise depends on market prices at the time of exercise. For other stock awards, these amounts represent the grant date fair value of the RSU awards determined in accordance with GAAP. See Note 20—Share-Based Compensation Plans in the Notes to Consolidated Financial Statements in our 2019Form 10-K, for a discussion of the relevant assumptions used in this determination.

|

44 2020 PROXY STATEMENT

EXECUTIVE COMPENSATION TABLES (5) For equity incentive plan awards, these amounts represent the grant date fair value at target level under the PSP as determined in accordance with GAAP. For Stock Option awards, these amounts represent the grant date fair value of the option awards using a Black-Scholes-Merton-based methodology. Actual value realized upon option exercise depends on market prices at the time of exercise. For other stock awards, these amounts represent the grant date fair value of the RSU awards determined in accordance with GAAP. See Note 20—Share-Based Compensation Plans in the Notes to Consolidated Financial Statements in our 2020 Form 10-K, for a discussion of the relevant assumptions used in this determination. OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END The following table lists outstanding Phillips 66 equity grants for each NEO as of December 31, 2019.2020. | | | OPTION AWARDS (1) | STOCK AWARDS | | NAME | GRANT DATE | NUMBER OF

SECURITIES

UNDERLYING

UNEXERCISED

OPTIONS

EXERCISABLE

(2)(#) | NUMBER OF

SECURITIES

UNDERLYING

UNEXERCISED

OPTIONS

UNEXERCISABLE(#) | OPTION

EXERCISE

PRICE ($) | OPTION

EXPIRATION

DATE | NUMBER OF

SHARES OR

UNITS OF

STOCK

THAT HAVE

NOT VESTED

(3)(#) | MARKET

VALUE OF

SHARES

OR UNITS

OF

STOCK

THAT

HAVE

NOT

VESTED

($) | EQUITY

INCENTIVE

PLAN

AWARDS:

NUMBER OF

UNEARNED

SHARES,

UNITS OR

OTHER

RIGHTS

THAT HAVE

NOT VESTED

(4) (#) | EQUITY

INCENTIVE

PLAN

AWARDS:

MARKET OR

PAYOUT

VALUE

OF UNEARNED

SHARES, UNITS

OR OTHER

RIGHTS THAT

HAVE NOT

VESTED

($) | | Greg Garland | 2/7/2013 | 158,500 | | — | | 62.170 | | 2/7/2023 | — | — | — | — | | 2/6/2014 | 126,300 | | — | | 72.255 | | 2/6/2024 | — | — | — | — | | 2/3/2015 | 146,700 | | — | | 74.135 | | 2/3/2025 | — | — | — | — | | 2/2/2016 | 169,400 | | — | | 78.620 | | 2/2/2026 | — | — | — | — | | 2/7/2017 | 174,000 | | — | | 78.475 | | 2/7/2027 | — | — | — | — | | 2/6/2018 | 98,000 | | 49,000 | | 94.850 | | 2/6/2028 | — | — | — | — | | 2/5/2019 | 59,566 | | 119,134 | | 94.968 | | 2/5/2029 | — | — | — | — | | 2/4/2020 | — | | 212,100 | | 89.570 | | 2/4/2030 | — | — | — | — | | | — | | — | | — | | — | | 98,698 | 6,902,938 | 292,900 | 20,485,426 | | Kevin Mitchell | 2/3/2015 | 9,900 | | — | | 74.135 | | 2/3/2025 | — | — | — | — | | 2/2/2016 | 30,800 | | — | | 78.620 | | 2/2/2026 | — | — | — | — | | 2/7/2017 | 31,700 | | — | | 78.475 | | 2/7/2027 | — | — | — | — | | 2/6/2018 | 29,066 | | 14,534 | | 94.850 | | 2/6/2028 | — | — | — | — | | 2/5/2019 | 17,766 | | 35,534 | | 94.968 | | 2/5/2029 | — | — | — | — | | 2/4/2020 | — | | 63,200 | | 89.570 | | 2/4/2030 | | | | | | | — | | — | | — | | — | | 33,525 | 2,344,739 | 95,966 | 6,711,862 | | Robert Herman | 2/7/2013 | 12,300 | | — | | 62.170 | | 2/7/2023 | — | — | — | — | | 2/6/2014 | 11,400 | | — | | 72.255 | | 2/6/2024 | — | — | — | — | | 2/3/2015 | 23,500 | | — | | 74.135 | | 2/3/2025 | — | — | — | — | | 2/2/2016 | 28,800 | | — | | 78.620 | | 2/2/2026 | — | — | — | — | | 2/7/2017 | 30,700 | | — | | 78.475 | | 2/7/2027 | — | — | — | — | | 2/6/2018 | 17,333 | | 8,667 | | 94.850 | | 2/6/2028 | — | — | — | — | | 2/5/2019 | 10,500 | | 21,000 | | 94.968 | | 2/5/2029 | — | — | — | — | | 2/4/2020 | — | | 48,500 | | 89.570 | | 2/4/2030 | | | | | | | — | | — | | — | | — | | 69,177 | 4,838,239 | 73,284 | 5,125,483 | | Paula Johnson | 2/7/2013 | 12,000 | | — | | 62.170 | | 2/7/2023 | — | — | — | — | | 2/6/2014 | 19,600 | | — | | 72.255 | | 2/6/2024 | — | — | — | — | | 2/3/2015 | 25,100 | | — | | 74.135 | | 2/3/2025 | — | — | — | — | | 2/2/2016 | 32,800 | | — | | 78.620 | | 2/2/2026 | — | — | — | — | | 2/7/2017 | 34,300 | | — | | 78.475 | | 2/7/2027 | — | — | — | — | | 2/6/2018 | 19,933 | | 9,967 | | 94.850 | | 2/6/2028 | — | — | — | — | | 2/5/2019 | 12,166 | | 24,334 | | 94.968 | | 2/5/2029 | — | — | — | — | | 2/4/2020 | — | | 45,900 | | 89.570 | | 2/4/2030 | | | | | | | — | | — | | — | | — | | 22,612 | 1,581,483 | 67,484 | 4,719,831 | | Tim Roberts | 4/4/2016 | 28,400 | | — | | 85.973 | | 4/4/2026 | — | — | — | — | | 2/7/2017 | 30,700 | | — | | 78.475 | | 2/7/2027 | — | — | — | — | | 2/6/2018 | 17,266 | | 8,634 | | 94.850 | | 2/6/2028 | — | — | — | — | | 2/5/2019 | 10,500 | | 21,000 | | 94.968 | | 2/5/2029 | — | — | — | — | | 2/4/2020 | — | | 48,500 | | 89.570 | | 2/4/2030 | | | | | | | — | | — | | — | | — | | 22,864 | 1,599,108 | 73,440 | 5,136,394 | | | | | | | | | | | | | | | | |

54 PHILLIPS 66 PROXY STATEMENT 2021 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | OPTION AWARDS(1) | | | STOCK AWARDS | | NAME | | GRANT

DATE | | | NUMBER OF

SECURITIES

UNDERLYING

UNEXERCISED

OPTIONS

EXERCISABLE(2)

(#) | | | NUMBER OF

SECURITIES

UNDERLYING

UNEXERCISED

OPTIONS

UNEXERCISABLE (#) | | | OPTION

EXERCISE

PRICE

($) | | | OPTION

EXPIRATION

DATE | | | NUMBER OF

SHARES OR

UNITS OF

STOCK THAT

HAVE NOT

VESTED(3)

(#) | | | MARKET

VALUE OF

SHARES OR

UNITS OF

STOCK THAT

HAVE NOT

VESTED

($) | | | EQUITY

INCENTIVE

PLAN

AWARDS:

NUMBER OF

UNEARNED

SHARES,

UNITS OR

OTHER

RIGHTS THAT

HAVE NOT

VESTED(4)

(#) | | | EQUITY

INCENTIVE

PLAN

AWARDS:

MARKET OR

PAYOUT

VALUE OF

UNEARNED

SHARES,

UNITS OR

OTHER RIGHTS

THAT HAVE

NOT VESTED

($) | | Greg Garland | | | 2/7/2013 | | | | 158,500 | | | | — | | | | 62.170 | | | | 2/7/2023 | | | | — | | | | — | | | | — | | | | — | | | | | 2/6/2014 | | | | 126,300 | | | | — | | | | 72.255 | | | | 2/6/2024 | | | | — | | | | — | | | | — | | | | — | | | | | 2/3/2015 | | | | 146,700 | | | | — | | | | 74.135 | | | | 2/3/2025 | | | | — | | | | — | | | | — | | | | — | | | | | 2/2/2016 | | | | 169,400 | | | | — | | | | 78.620 | | | | 2/2/2026 | | | | — | | | | — | | | | — | | | | — | | | | | 2/7/2017 | | | | 116,000 | | | | 58,000 | | | | 78.475 | | | | 2/7/2027 | | | | — | | | | — | | | | — | | | | — | | | | | 2/6/2018 | | | | 49,000 | | | | 98,000 | | | | 94.850 | | | | 2/6/2028 | | | | — | | | | — | | | | — | | | | — | | | | | 2/5/2019 | | | | — | | | | 178,700 | | | | 94.968 | | | | 2/5/2029 | | | | — | | | | — | | | | — | | | | — | | | | | | | | | — | | | | — | | | | — | | | | — | | | | 297,381 | | | | 33,131,217 | | | | 294,568 | | | | 32,817,821 | | Kevin Mitchell | | | 2/3/2015 | | | | 9,900 | | | | — | | | | 74.135 | | | | 2/3/2025 | | | | — | | | | — | | | | — | | | | — | | | | | 2/2/2016 | | | | 30,800 | | | | — | | | | 78.620 | | | | 2/2/2026 | | | | — | | | | — | | | | — | | | | — | | | | | 2/7/2017 | | | | 21,133 | | | | 10,567 | | | | 78.475 | | | | 2/7/2027 | | | | — | | | | — | | | | — | | | | — | | | | | 2/6/2018 | | | | 14,533 | | | | 29,067 | | | | 94.850 | | | | 2/6/2028 | | | | — | | | | — | | | | — | | | | — | | | | | 2/5/2019 | | | | — | | | | 53,300 | | | | 94.968 | | | | 2/5/2029 | | | | — | | | | — | | | | — | | | | — | | | | | | | | | — | | | | — | | | | — | | | | — | | | | 28,115 | | | | 3,132,292 | | | | 96,280 | | | | 10,726,555 | | Robert Herman | | | 2/7/2013 | | | | 12,300 | | | | — | | | | 62.170 | | | | 2/7/2023 | | | | — | | | | — | | | | — | | | | — | | | | | 2/6/2014 | | | | 11,400 | | | | — | | | | 72.255 | | | | 2/6/2024 | | | | — | | | | — | | | | — | | | | — | | | | | 2/3/2015 | | | | 23,500 | | | | — | | | | 74.135 | | | | 2/3/2025 | | | | — | | | | — | | | | — | | | | — | | | | | 2/2/2016 | | | | 28,800 | | | | — | | | | 78.620 | | | | 2/2/2026 | | | | — | | | | — | | | | — | | | | — | | | | | 2/7/2017 | | | | 20,466 | | | | 10,234 | | | | 78.475 | | | | 2/7/2027 | | | | — | | | | — | | | | — | | | | — | | | | | 2/6/2018 | | | | 8,666 | | | | 17,334 | | | | 94.850 | | | | 2/6/2028 | | | | — | | | | — | | | | — | | | | — | | | | | 2/5/2019 | | | | — | | | | 31,500 | | | | 94.968 | | | | 2/5/2029 | | | | — | | | | — | | | | — | | | | — | | | | | | | | | — | | | | — | | | | — | | | | — | | | | 67,101 | | | | 7,475,722 | | | | 69,538 | | | | 7,747,229 | | Paula Johnson | | | 2/7/2013 | | | | 12,000 | | | | — | | | | 62.170 | | | | 2/7/2023 | | | | — | | | | — | | | | — | | | | — | | | | | 2/6/2014 | | | | 19,600 | | | | — | | | | 72.255 | | | | 2/6/2024 | | | | — | | | | — | | | | — | | | | — | | | | | 2/3/2015 | | | | 25,100 | | | | — | | | | 74.135 | | | | 2/3/2025 | | | | — | | | | — | | | | — | | | | — | | | | | 2/2/2016 | | | | 32,800 | | | | — | | | | 78.620 | | | | 2/2/2026 | | | | — | | | | — | | | | — | | | | — | | | | | 2/7/2017 | | | | 22,866 | | | | 11,434 | | | | 78.475 | | | | 2/7/2027 | | | | — | | | | — | | | | — | | | | — | | | | | 2/6/2018 | | | | 9,966 | | | | 19,934 | | | | 94.850 | | | | 2/6/2028 | | | | — | | | | — | | | | — | | | | — | | | | | 2/5/2019 | | | | — | | | | 36,500 | | | | 94.968 | | | | 2/5/2029 | | | | — | | | | — | | | | — | | | | — | | | | | | | | | — | | | | — | | | | — | | | | — | | | | 49,125 | | | | 5,473,016 | | | | 65,986 | | | | 7,351,500 | | Tim Roberts | | | 4/4/2016 | | | | 28,400 | | | | — | | | | 85.973 | | | | 4/4/2026 | | | | — | | | | — | | | | — | | | | — | | | | | 2/7/2017 | | | | 20,466 | | | | 10,234 | | | | 78.475 | | | | 2/7/2027 | | | | — | | | | — | | | | — | | | | — | | | | | 2/6/2018 | | | | 8,633 | | | | 17,267 | | | | 94.850 | | | | 2/6/2028 | | | | — | | | | — | | | | — | | | | — | | | | | 2/5/2019 | | | | — | | | | 31,500 | | | | 94.968 | | | | 2/5/2029 | | | | — | | | | — | | | | — | | | | — | | | | | | | | | | — | | | | — | | | | — | | | | — | | | | 19,232 | | | | 2,142,637 | | | | 66,620 | | | | 7,422,134 | |

EXECUTIVE COMPENSATION TABLES (1) | (1) | All options shown in the table have a maximum term for exercise of ten years from the grant date. Under certain circumstances, the terms for exercise may be shorter, and in certain circumstances, the options may be forfeited and cancelled. All awards shown in the table have associated restrictions upon transferability. |

2020 PROXY STATEMENT 45

EXECUTIVE COMPENSATION TABLES

(2) | (2) | The options shown in this column vested and became exercisable in 20192020 or prior years (although under certain termination circumstances, the options may still be forfeited). Options become exercisable inone-third increments on the first, second and third anniversaries of the grant date. |

(3) | (3) | These amounts include unvested restricted stock and RSUs awarded under the PSP for performance periods that ended on or before December 31, 2014, and awarded as annual awards.2014. All awards for performance periods that ended on or before December 31, 2014, continue to have restrictions upon transferability. Restrictions on PSP awards for performance periods that ended on or before December 31, 2010, lapse upon separation from service. Restrictions on PSP awards for later performance periods lapse five years from the grant date unless the NEO elected prior to the beginning of the performance period to defer lapsing of the restrictions until separation from service. Awards are subject to forfeiture if, prior to lapsing, the NEO separates from service for a reason other than death, disability, layoff, retirement after reaching age 55 with five years of service, or after a change of control, although the Compensation Committee has the authority to waive forfeiture. The awards have no voting rights, but do entitle the holder to receive dividend equivalents in cash. The value of the awards reflects the closing price of our common stock, as reported on the NYSE, on December 31, 20192020 ($111.41)69.94). |

(4) | (4) | Reflects potential awards from ongoing performance periods under the PSP for performance periods ending December 31, 2020,2021 and December 31, 2021.2022. These awards are shown at maximum; however, there is no assurance that awards will be granted at, below or above target after the end of the relevant performance periods, as the determination to make a grant and the amount of any grant is within the judgment of the Compensation Committee. Until an actual grant is made, these unearned awards pay no dividend equivalents. The value of these unearned awards reflects the closing price of our common stock, as reported on the NYSE, on December 31, 20192020 ($111.41)69.94). |

OPTION EXERCISES AND STOCK VESTED FOR 20192020 The following table summarizes the value received from stock option exercises and stock grants vested during 2019:2020: | | OPTION AWARDS | STOCK AWARDS (1) | | NAME | NUMBER OF SHARES ACQUIRED

ON EXERCISE

(#) | VALUE REALIZED

UPON EXERCISE

($) | NUMBER OF SHARES ACQUIRED ON VESTING

(#) | VALUE REALIZED UPON VESTING

($) | | Greg Garland | — | — | 319,292 | 26,857,890 | | Kevin Mitchell | — | — | 33,931 | 2,461,625 | | Robert Herman | — | — | 25,618 | 1,895,314 | | Paula Johnson | — | — | 54,035 | 4,443,795 | | Tim Roberts | — | — | 24,871 | 1,839,209 |

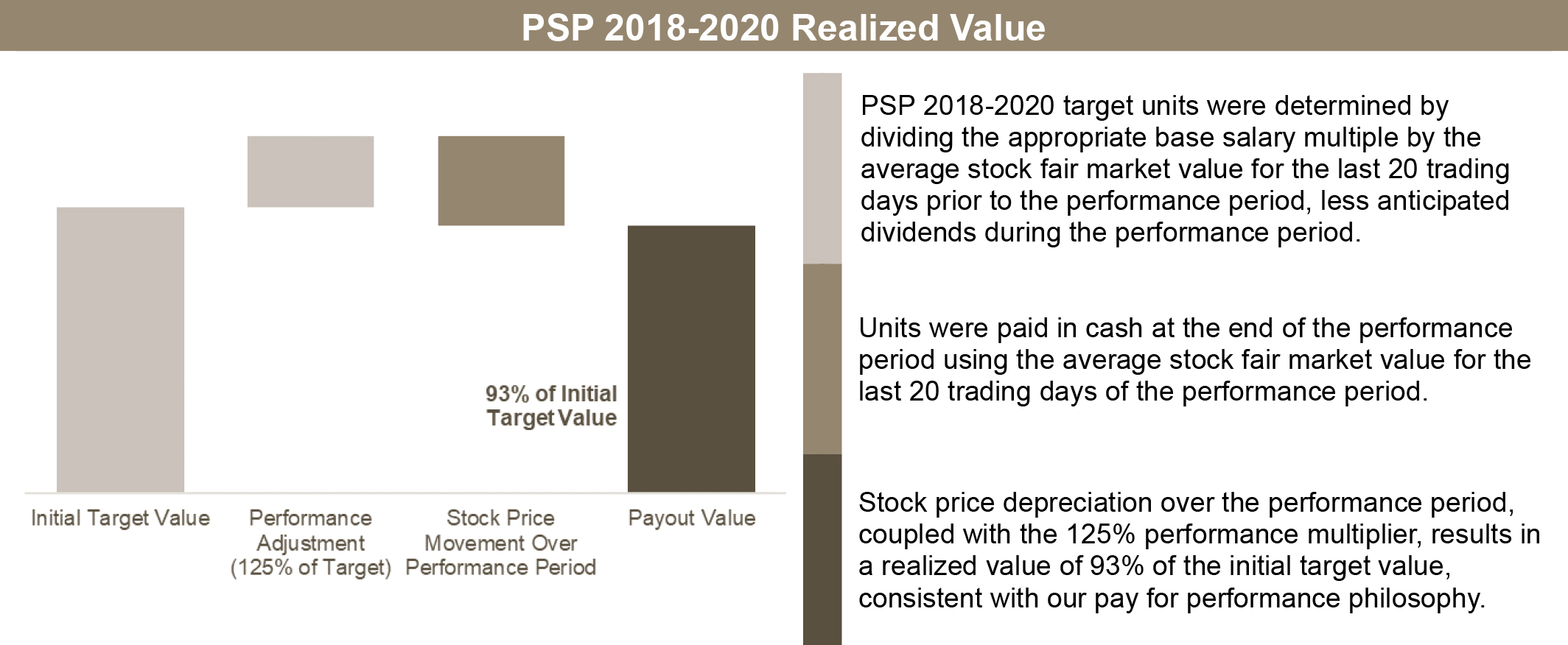

(1) Stock awards include RSUs that vested during the year, as well as the PSP 2018-2020 award that vested on December 31, 2020 and was paid out in cash in early 2021. The PSP awards were as follows: Mr. Garland, 83,208 units valued at | | | | | | | | | | | | | | | | | | | | OPTION AWARDS | | | STOCK AWARDS(1) | | NAME | | NUMBER OF SHARES

ACQUIRED ON EXERCISE

(#) | | | VALUE REALIZED UPON

EXERCISE

($) | | | NUMBER OF SHARES

ACQUIRED ON VESTING

(#) | | | VALUE REALIZED UPON

VESTING

($) | | Greg Garland | | | 42,728 | | | | 2,802,154 | | | | 333,687 | | | | 33,714,892 | | Kevin Mitchell | | | — | | | | — | | | | 32,494 | | | | 3,531,910 | | Robert Herman | | | 47,433 | | | | 3,374,428 | | | | 30,056 | | | | 3,267,034 | | Paula Johnson | | | — | | | | — | | | | 51,943 | | | | 5,373,632 | | Tim Roberts | | | — | | | | — | | | | 27,323 | | | | 2,971,096 | |

(1) | Stock awards include RSUs that vested during the year, as well as the PSP 2017-2019 award that vested on December 31, 2019, and was paid out in cash in early 2020. The PSP awards were as follows: Mr. Garland, 115,275 units valued at $12,994,928; Mr. Mitchell, 25,229 units valued at $2,844,060; Mr. Herman, 23,314 units valued at $2,628,183; Ms. Johnson, 24,991 units valued at $2,817,230; and Mr. Roberts, 21,283 units valued at $2,399,228.PHILLIPS 66 PROXY STATEMENT 2021 55

|

EXECUTIVE COMPENSATION TABLES $5,672,888; Mr. Mitchell, 27,096 units valued at $1,847,329; Mr. Herman, 18,299 units valued at $1,247,575; Ms. Johnson, 18,620 units valued at $1,269,459; and Mr. Roberts, 18,254 units valued at $1,244,507. PENSION BENEFITS AS OF DECEMBER 31, 20192020 Our defined benefit pension plan covering NEOs, the Phillips 66 Retirement Plan, consists of multiple titles with different terms. NEOs are only eligible to participate in one title at any time but may have frozen benefits under one or more other titles. | | | | | | | | | | TITLE I | | TITLE II(1) | | TITLE IV | Current Eligibility | | Mr. Garland | | Mr. Herman(4), Mr. Mitchell,Mr. Roberts | | Ms. Johnson | Normal Retirement | | Age 65 | | Age 65 | | Age 65 | Early Retirement(2) | | Age 55 with five years of service or if laid off during or after the year in which the participant reaches age 50 | | Executives may receive their vested benefit upon termination of employment at any age | | Age 50 with ten years of service | Benefit Calculation(2) | | Calculated as the product of 1.6% times years of credited service multiplied by the final average eligible earnings | | Based on monthly pay and interest credits to a nominal cash balance account created on the first day of the month after an executive’sexecutive's hire date. Pay credits are equal to a percentage of total salary and annual bonus. | | Calculated as the product of 1.6% times years of credited service multiplied by the final average eligible earnings | Final Average Earnings Calculation | | Calculated using the three highest compensation years in the last ten calendar years before retirement plus the year of retirement | | N/A | | Calculated using the higher of the highest three years of compensation or the highest 36 months of compensation | Eligible Pension Compensation(3) | | Includes salary and annual bonus | | Includes salary and annual bonus | | Includes salary and annual bonus | Benefit Vesting | | All participants are vested in this title | | Employees vest after three years of service | | All participants are vested in this title | Payment Types | | Allows payments in the form of several annuity types or a single lump sum | | | IRS limitations | | Benefits under all Titles are limited by the IRC. In 2019,2020, the compensation limit was $280,000.$285,000. The IRC also limits the annual benefit available under these Titles expressed as an annuity. In 2019,2020, that limit was $225,000$230,000 (reduced actuarially for ages below 62). |

(1) | (1) | NEOs whose combined years of age and service total less than 44 receive a 6% pay credit, those with 44 through 65 receive a 7% pay credit and those with 66 or more receive a 9% pay credit. Interest credits are applied to the cash balance account each month. This credit is calculated by multiplying the value of the account by the interest credit rate, based on30-year U.S. Treasury security rates adjusted quarterly. |

(2) | (2) | An early benefit reduction is calculated on Title I by reducing the benefit 5% for each year before age 60 that benefits are paid. An early benefit reduction is calculated on Title III by reducing the benefit 6.67% for each year before age 60 that benefits are paid, unless the participant has at least 85 points awarded, with one point for each year of age and one point for each year of service. Title IV early benefit reduction is calculated by reducing the benefit by 5% per year for each year before age 57 that benefits are paid and 4% per year for benefits that are paid between ages 57 and 60. The benefit calculation for Titles I, III and IV is reduced by the product of 1.5% of the annual primary social security benefit multiplied by years of credited service, although a reduction limit of 50% of the primary Social Security benefit may apply. |

(3) | (3) | Under Title I, if an executive receives layoff benefits, then the eligible compensation calculation also includes the annualized salary for the year of layoff (rather than the actual salary for that year) and years of service are increased by any period for which layoff benefits are calculated. |

(4) | (4) | Mr. Herman has a frozen benefit under Title III from prior years of service with predecessor companies. Under Title III, normal retirement is age 65 and early retirement is age 55 with 10 years of service. Title III is similar to Title I, except that bonus is not eligible pension compensation and payout is made in the form of an annuity. |

56 PHILLIPS 66 PROXY STATEMENT 2021 | |

EXECUTIVE COMPENSATION TABLES The following table lists the pension program participation and actuarial present value of each NEO’sNEO's defined benefit pension as of December 31, 2019.2020. | NAME | PLAN NAME | NUMBER OF YEARS CREDITED SERVICE (1) (#) | PRESENT VALUE OF ACCUMULATED BENEFIT ($) | PAYMENTS DURING LAST FISCAL YEAR

($) | | Greg Garland | Phillips 66 Retirement Plan - Title I | 31 | 2,076,817 | — | | | Phillips 66 Key Employee Supplemental Retirement Plan (2) | — | 51,817,577 | — | | Kevin Mitchell | Phillips 66 Retirement Plan - Title II | 7 | 165,494 | — | | | Phillips 66 Key Employee Supplemental Retirement Plan (2) | — | 777,384 | — | | Robert Herman | Phillips 66 Retirement Plan - Title II | 15 | 431,255 | — | | | Phillips 66 Retirement Plan - Title III | 23 | 716,291 | — | | | Phillips 66 Key Employee Supplemental Retirement Plan (2) | — | 1,244,447 | — | | Paula Johnson | Phillips 66 Retirement Plan - Title IV | 18 | 1,115,296 | — | | | Phillips 66 Key Employee Supplemental Retirement Plan (2) | — | 8,042,831 | — | | Tim Roberts | Phillips 66 Retirement Plan - Title II | 5 | 96,489 | — | | | Phillips 66 Key Employee Supplemental Retirement Plan (2) | — | 453,129 | — |

(1)Years of credited service include service recognized under the predecessor ConocoPhillips plans from which these plans were spun off effective May 1, 2012. Credited Service displays the number of years the NEO was in each applicable formula. (2) The Phillips 66 Key Employee Supplemental Retirement Plan restores Company-sponsored benefits capped under the qualified defined benefit pension plan due to IRC limits. All employees, including our NEOs, are eligible to participate in the plan. | | | | | | | | | | | | | | | NAME | | PLAN NAME | | NUMBER OF YEARS

CREDITED SERVICE(1)

(#) | | | PRESENT VALUE OF

ACCUMULATED

BENEFIT ($) | | | PAYMENTS DURING

LAST FISCAL YEAR

($) | | Greg Garland | | Phillips 66 Retirement Plan - Title I | | | 30 | | | | 1,891,256 | | | | — | | | | Phillips 66 Key Employee Supplemental Retirement Plan(2) | | | — | | | | 45,151,254 | | | | — | | Kevin Mitchell | | Phillips 66 Retirement Plan - Title II | | | 6 | | | | 134,673 | | | | — | | | | Phillips 66 Key Employee Supplemental Retirement Plan(2) | | | — | | | | 549,659 | | | | — | | Robert Herman | | Phillips 66 Retirement Plan - Title II | | | 14 | | | | 393,783 | | | | — | | | | Phillips 66 Retirement Plan - Title III | | | 22 | | | | 634,293 | | | | — | | | | Phillips 66 Key Employee Supplemental Retirement Plan(2) | | | — | | | | 1,045,467 | | | | — | | Paula Johnson | | Phillips 66 Retirement Plan - Title IV | | | 17 | | | | 923,584 | | | | — | | | | Phillips 66 Key Employee Supplemental Retirement Plan(2) | | | — | | | | 6,049,191 | | | | — | | Tim Roberts | | Phillips 66 Retirement Plan - Title II | | | 4 | | | | 49,568 | | | | — | | | | | Phillips 66 Key Employee Supplemental Retirement Plan(2) | | | — | | | | 202,306 | | | | — | |

Understanding the Annual Change in Pension Value (1)No modifications to pension | Years

ü There were no modifications to our existing pension program in 2020 | | Change in value | ü The value of credited service include service recognized under the predecessor ConocoPhillipstraditional pension plans fromis particularly sensitive to interest rate movement, which these plans were spun off effective May 1, 2012. Credited Service displays the numberis outside of years the NEO was in each applicable formula.Company control ü While our short-term and long-term incentive programs are based entirely on performance, pension value is not performance based and does not reflect or reward Company performance | | Pension plan going forward | ü The Compensation Committee will continue to assess our pension program to ensure viability as an attraction and retention tool |

(2) | The Phillips 66 Key Employee Supplemental Retirement Plan restores Company-sponsored benefits capped under the qualified defined benefit pension plan due to IRC limits. All employees, including our NEOs, are eligible to participate in the plan.

|

NONQUALIFIED DEFERRED COMPENSATION Our NEOs are eligible to participate in two nonqualified deferred compensation plans, the Phillips 66 KEDCP and the Phillips 66 DCMP. The KEDCP allows NEOs to defer up to 50% of their salary and up to 100% of their VCIP. The default distribution option is a lump sum payment paid at least six months after separation from service. NEOs may elect to defer payments from one to five years, and to receive annual, semiannual or quarterly payments for a period of up to fifteen years. NEOs may also elect to defer their VCIP to a specific date in the future. The DCMP is a nonqualified restoration plan for employer contributions that cannot be made to our 401(k) plan either due to an NEO’sNEO's salary deferral under the KEDCP or due to the IRC annual limit on compensation that may be taken into account under a qualified plan. Distributions are made as a lump sum six months after separation | PHILLIPS 66 PROXY STATEMENT 2021 57 |

EXECUTIVE COMPENSATION TABLES from service, unless the NEO elects to receive one to fifteen annual payments beginning at least one year after separation from service. Each NEO directs investments of his or her individual accounts under the KEDCP and DCMP. Both plans provide a broad range of market-based investments, that may be changed daily. No investment provides above-market returns. The aggregate performance of these investments is reflected in theNONQUALIFIED DEFERRED COMPENSATION table below. Benefits due under these plans are paid from our general assets, although we also maintain rabbi trusts that may be used to pay benefits. The trusts and the funds held in them are Company assets. In the event of our bankruptcy, NEOs would be unsecured general creditors. 48 2020 PROXY STATEMENT

EXECUTIVE COMPENSATION TABLES

The following table provides information on nonqualified deferred compensation as of December 31, 2019:2020: | NAME | APPLICABLE PLAN (1) | BEGINNING

BALANCE

(2) ($) | EXECUTIVE

CONTRIBUTIONS

IN LAST

FISCAL YEAR

($) | COMPANY

CONTRIBUTIONS

IN THE LAST

FISCAL YEAR (3) ($) | AGGREGATE

EARNINGS

IN LAST

FISCAL YEAR

(4) ($) | AGGREGATE

WITHDRAWALS/

DISTRIBUTIONS ($) | AGGREGATE

BALANCE

AT LAST

FISCAL

YEAR END (5) ($) | | Greg Garland | Phillips 66 Defined Contribution

Make-Up Plan | 2,385,595 | — | 534,983 | 24,002 | — | 2,944,579 | Phillips 66 Key Employee

Deferred Compensation Plan | 1,435,135 | — | — | (383,312) | — | 1,051,822 | | Kevin Mitchell | Phillips 66 Defined Contribution

Make-Up Plan | 471,936 | — | 192,294 | 82,716 | — | 746,937 | Phillips 66 Key Employee

Deferred Compensation Plan | — | — | — | — | — | — | | Robert Herman | Phillips 66 Defined Contribution

Make-Up Plan | 740,799 | — | 155,612 | (4,175) | — | 892,236 | Phillips 66 Key Employee

Deferred Compensation Plan | 2,525,254 | — | — | 362,366 | — | 2,887,620 | | Paula Johnson | Phillips 66 Defined Contribution

Make-Up Plan | 609,842 | — | 164,494 | 67,150 | — | 841,486 | Phillips 66 Key Employee

Deferred Compensation Plan | — | — | — | — | — | — | | Tim Roberts | Phillips 66 Defined Contribution

Make-Up Plan | 333,783 | — | 164,827 | 64,577 | — | 563,188 | Phillips 66 Key Employee

Deferred Compensation Plan | — | 697,622 | — | 58,845 | — | 756,467 |

(1) We have two defined contribution deferred compensation programs for our executives -- the DCMP and the KEDCP. As of December 31, 2020, participants in these plans had 36 investment options -- 28 of the options were the same as those available in our 401(k) plan and the remaining options were other mutual funds approved by the plan administrator. (2) The beginning balance includes the final Company contribution of fiscal year 2019 (DCMP $6,792 and KEDCP $4,542 for Mr. Garland; DCMP $7,779 for Mr. Mitchell; DCMP $5,051 and KEDCP $22,806 for Mr. Herman; DCMP $6,495 for Ms. Johnson; and DCMP $5,907 for Mr. Roberts). | | | | | | | | | | | | | | | | | | | | | | | | | | | NAME | | APPLICABLE PLAN(1) | | BEGINNING

BALANCE

($) | | | EXECUTIVE

CONTRIBUTIONS

IN LAST FISCAL

YEAR

($) | | | COMPANY

CONTRIBUTIONS

IN THE LAST

FISCAL YEAR(2)

($) | | | AGGREGATE

EARNINGS IN

LAST FISCAL

YEAR(3)

($) | | | AGGREGATE WITHDRAWALS/ DISTRIBUTIONS

($) | | | AGGREGATE

BALANCE

AT LAST

FISCAL

YEAR END(4)

($) | | Greg Garland | | Phillips 66 Defined ContributionMake-Up Plan | | | 1,272,963 | | | | — | | | | 758,198 | | | | 347,642 | | | | — | | | | 2,378,803 | | | | Phillips 66 Key Employee Deferred Compensation Plan | | | 1,252,805 | | | | — | | | | — | | | | 177,789 | | | | — | | | | 1,430,593 | | Kevin Mitchell | | Phillips 66 Defined ContributionMake-Up Plan | | | 118,094 | | | | — | | | | 295,365 | | | | 50,689 | | | | — | | | | 464,147 | | | | Phillips 66 Key Employee Deferred Compensation Plan | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | Robert Herman | | Phillips 66 Defined ContributionMake-Up Plan | | | 397,058 | | | | — | | | | 229,034 | | | | 109,656 | | | | — | | | | 735,748 | | | | Phillips 66 Key Employee Deferred Compensation Plan | | | 1,982,729 | | | | — | | | | — | | | | 519,720 | | | | — | | | | 2,502,448 | | Paula Johnson | | Phillips 66 Defined ContributionMake-Up Plan | | | 255,929 | | | | — | | | | 244,519 | | | | 102,899 | | | | — | | | | 603,347 | | | | Phillips 66 Key Employee Deferred Compensation Plan | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | Tim Roberts | | Phillips 66 Defined ContributionMake-Up Plan | | | 69,936 | | | | — | | | | 228,922 | | | | 29,018 | | | | — | | | | 327,876 | | | | | Phillips 66 Key Employee Deferred Compensation Plan | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

(3) These amounts represent Company contributions under the DCMP. These amounts are also included in the "All Other Compensation" column of the SUMMARY COMPENSATION TABLE. (4) These amounts represent earnings on plan balances from January 1 to December 31, 2020. These amounts are not included in the SUMMARY COMPENSATION TABLE. (5) The total reflects contributions by our NEOs, contributions by us, and earnings on balances prior to 2020; plus contributions by our NEOs, and earnings from January 1, 2020, through December 31, 2020 (shown in the appropriate columns of this table, with amounts that are included in the SUMMARY COMPENSATION TABLE). The total includes all contributions by our NEOs and by us reported in this proxy statement and our proxy statements from prior years as follows: $2,106,109 for Mr. Garland; $580,697 for Mr. Mitchell; $466,016 for Mr. Herman; $750,079 for Ms. Johnson; and $1,115,552 for Mr. Roberts. (1)58 PHILLIPS 66 PROXY STATEMENT 2021 | We have two defined contribution deferred compensation programs for our executives — the DCMP and the KEDCP. As of December 31, 2019, participants in these plans had 36 investment options — 28 of the options were the same as those available in our 401(k) plan and the remaining options were other mutual funds approved by the plan administrator.

|

(2) | These amounts represent Company contributions under the DCMP. These amounts are also included in the “All Other Compensation” column of theSUMMARY COMPENSATION TABLE.

|

(3) | These amounts represent earnings on plan balances from January 1 to December 31, 2019. These amounts are not included in theSUMMARY COMPENSATION TABLE.

|

(4) | EXECUTIVE COMPENSATION TABLES The total reflects contributions by our NEOs, contributions by us, and earnings on balances prior to 2019; plus contributions by our NEOs, and earnings from January 1, 2019, through December 31, 2019 (shown in the appropriate columns of this table, with amounts that are included in theSUMMARY COMPENSATION TABLE). The total includes all contributions by our NEOs and by us reported in this proxy statement and our proxy statements from prior years as follows: $1,571,126 for Mr. Garland; $388,403 for Mr. Mitchell; $310,404 for Mr. Herman; $456,237 for Ms. Johnson; and $253,103 for Mr. Roberts.

|

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL Each of our NEOs is expectedOur programs are designed to receivepay out amounts earned during his or her period of employment unless he or shethe employee voluntarily resigns prior to becoming retirement-eligible or is terminated for cause. Although normal retirement age under our benefit plans is 65, early retirement provisions allow receipt of benefits at earlier ages if vesting requirements are met. For our incentive compensation programs (VCIP, RSU, Stock Options, and PSP), early retirement is generally defined as termination at or after the age of 55 with five years of service.

As of December 31, 2019,2020, Mr. Garland, Mr. Herman, and Ms. Johnson were retirement-eligible under both our benefit plans and our compensation programs. Therefore, as of December 31, 2019,2020, a voluntary resignation of Mr. Garland, Mr. Herman, or Ms. Johnson, would have been treated as a retirement, and each would have retained all awards earned under the current and earlier programs. As such, awards under these programs are not included in the amounts reflected in the table below. Please see theOUTSTANDING EQUITY AWARDS AT FISCAL YEAR END table for more information. Our compensation programs provide for the following upon retirement: Cash Payments.Cash payments include VCIP earned during the fiscal year, amounts contributed and vested under our defined contribution plans, and amounts accrued and vested under our pension plans. Equity.Equity considerations include grants under the PSP for ongoing performance periods in which the executive participated for at least one year, previously granted restricted stock and RSUs, and previously granted stock option awards exercisable through the original term. 2020 PROXY STATEMENT 49

EXECUTIVE COMPENSATION TABLES

The table at the end of this section summarizes the potential additional value of the benefits to be received by each NEO as of December 31, 2019,2020, through the Phillips 66 ESP due to an involuntary termination without cause or through the Phillips 66 CICSP due to a change in control event. Benefits that would be available generally to all or substantially all salaried employees on the U.S. payroll are not included in the amounts shown. Executives are not entitled to receive benefits under both the ESP and the CICSP as a result of the same event. These two plans have the following in common: amounts payable under both are offset by any payments or benefits payable under any of our other plans; benefits under both may also be reduced in the event of willful and bad faith conduct demonstrably injurious to the Company; and both are Company plans under which awards and payments are subject to clawback provisions and to forfeiture or recoupment, in whole or in part, under applicable law, including the Sarbanes-Oxley Act and the Dodd-Frank Act. Executive Severance Plan The ESP provides that if ana NEO separates due to an involuntary termination without cause, the executive will receive the following benefits, which may vary depending on salary grade level. Cash Severance Payments. ESP cash severance payments include: a lump sum payment equal to one andone-half or two times the sum of the executive’sexecutive's base salary and current target annual bonus; a lump sum payment equal to the present value of the increase in pension benefits that would result from crediting the executive with an additional one andone-half or two years of age and service under the pension plan; and a lump sum payment generally equal to the Company contribution for active employees toward the cost of certain welfare benefits for an additional one andone-half or two years. | PHILLIPS 66 PROXY STATEMENT 2021 59 |

EXECUTIVE COMPENSATION TABLES Accelerated Equity.Layoff treatment under our compensation plans generally allows the executive to retain a prorated portion of grants held less than one year and full grants held for one year or more of Restricted Stock, RSUs, and Stock Options, and maintain eligibility for prorated PSP awards for ongoing periods in which he or she had participated for at least one year. Change in Control Severance Plan The CICSP provides that if, within two years of a change in control of the Company, an executive’sexecutive's employment is terminated by the employer other than for cause, or by the executive for good reason, the executive will receive the following benefits, which may vary depending on salary grade level. CICSP benefits include: Cash Severance Payments.CICSP cash severance payments include: a lump sum payment equal to two or three times the sum of the executive’sexecutive's base salary and the higher of the current target annual bonus or the average of the annual bonuses paid for the previous two years; a lump sum payment equal to the present value of the increase in pension benefits that would result from crediting the executive with an additional two or three years of age and service under the pension plan; and, a lump sum payment generally equal to the Company contribution for active employees toward the cost of certain welfare benefits for an additional two or three years. Accelerated Equity. CICSP benefits include the vesting of all equity awards and lapsing of any restrictions. 60 PHILLIPS 66 PROXY STATEMENT 2021 | |

50 2020 PROXY STATEMENT

EXECUTIVE COMPENSATION TABLES Death or Disability For completeness, payments that would be payable to each NEO upon separation as a result of disability or to each NEO’s estate as a result of death are likewise provided. | | | | EXECUTIVE BENEFITS AND PAYMENTS UPON TERMINATION | | EXECUTIVE BENEFITS AND PAYMENTS UPON TERMINATION | | | | INVOLUNTARY

NOT-FOR-CAUSE

TERMINATION

(NOT CIC)

($) | | | INVOLUNTARY OR

GOOD REASON

TERMINATION

(CIC)

($) | | | DEATH

($) | | | DISABILITY

($) | | INVOLUNTARY

NOT-FOR-CAUSE

TERMINATION

(NOT CIC)

($) | INVOLUNTARY OR

GOOD REASON

TERMINATION

(CIC)

($) | DEATH

($) | DISABILITY

($) | Greg Garland | | | | | | | | | | Severance Payment | | | 11,930,806 | | | | 22,893,237 | | | | — | | | | — | | 12,303,066 | 25,690,632 | — | — | Accelerated Equity | | | — | | | | — | | | | — | | | | — | | — | — | Life Insurance | | | — | | | | — | | | | 3,350,016 | | | | — | | — | 3,350,016 | — | TOTAL | | 11,930,806 | | | 22,893,237 | | | 3,350,016 | | | — | | 12,303,066 | 25,690,632 | 3,350,016 | — | Kevin Mitchell | | | | | | | | | | Severance Payment | | | 3,818,224 | | | | 7,194,493 | | | | — | | | | — | | 3,970,421 | 8,494,946 | — | — | Accelerated Equity(1) | | | 10,516,893 | | | | 10,683,636 | | | | 10,516,893 | | | | 10,516,893 | | 6,006,409 | 6,074,923 | 6,006,409 | 6,006,409 | Life Insurance | | | — | | | | — | | | | 1,734,000 | | | | — | | — | 1,806,864 | — | TOTAL | | 14,335,117 | | | 17,878,129 | | | 12,250,893 | | | 10,516,893 | | 9,976,830 | 14,569,869 | 7,813,273 | 6,006,409 | Robert Herman | | | | | | | | | | Severance Payment | | | 3,550,519 | | | | 6,210,172 | | | | — | | | | — | | 3,635,878 | 6,991,915 | — | — | Accelerated Equity | | | — | | | | — | | | | — | | | | — | | — | — | Life Insurance | | | — | | | | — | | | | 1,700,016 | | | | — | | — | 1,740,864 | — | TOTAL | | 3,550,519 | | | 6,210,172 | | | 1,700,016 | | | — | | 3,635,878 | 6,991,915 | 1,740,864 | — | Paula Johnson | | | | | | | | | | Severance Payment | | | 4,869,860 | | | | 8,811,801 | | | | — | | | | — | | 5,367,208 | 9,803,192 | — | — | Accelerated Equity | | | — | | | | — | | | | — | | | | — | | — | — | Life Insurance | | | — | | | | — | | | | 1,610,832 | | | | — | | — | 1,672,080 | — | TOTAL | | 4,869,860 | | | 8,811,801 | | | 1,610,832 | | | — | | 5,367,208 | 9,803,192 | 1,672,080 | — | Tim Roberts | | | | | | | | | | Severance Payment | | | 3,480,398 | | | | 6,229,801 | | | | — | | | | — | | 3,638,964 | 7,102,266 | — | — | Accelerated Equity(1) | | | 7,374,303 | | | | 7,472,887 | | | | 7,374,303 | | | | 7,374,303 | | 4,251,583 | 4,308,928 | 4,251,583 | 4,251,583 | Life Insurance | | | — | | | | — | | | | 1,700,016 | | | | — | | — | 1,774,848 | — | TOTAL | | 10,854,701 | | | 13,702,688 | | | 9,074,319 | | | 7,374,303 | | 7,890,547 | 11,411,194 | 6,026,431 | 4,251,583 |

(1) | (1) | For the PSP, amounts for PSP 2017-20192018-2020 are shown based on the cash amount received in February 2020,2021, while amounts for other periods are prorated to reflect the portion of the performance period completed by the end of 20192020 and shown at target payout levels. These amounts reflect the closing price of our common stock as reported on the NYSE on December 31, 20192020 ($111.41)69.94). |

Restricted Stock and RSU amounts reflect the closing price of our common stock as reported on the NYSE on December 31, 2020 ($69.94). | Restricted Stock and RSU amounts reflect the closing price of our common stock as reported on the NYSE on December 31, 2019 ($111.41).

|

| Stock Option amounts reflect the intrinsic value as if the options had been exercised on December 31, 2019,Stock Option amounts reflect the intrinsic value as if the options had been exercised on December 31, 2020, but only for options the NEO would have retained for the specific termination event.

| PHILLIPS 66 PROXY STATEMENT 2021 61 |

EXECUTIVE COMPENSATION TABLES CEO PAY RATIO As required by Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(u) of RegulationS-K, we are providing the following information about the ratio of the annual total compensation, calculated in accordance with the requirements of Item 402(c)(2)(x) of RegulationS-K, of our median employee and the annual total compensation of our CEO. For 2019,2020, the annual total compensation of our CEO was 169149 times that of the median of the annual total compensation of all employees, based on annual total compensation of $31,927,081$25,016,843 for the CEO and $188,738$167,382 for the median employee. 2020 PROXY STATEMENT 51

EXECUTIVE COMPENSATION TABLES

This ratio is based on an October 1, 2017,2020, employee population of 14,316, which excluded 412413 non-U.S. employees in Germany (270)(260), Singapore (71)(75), Austria (39)(42), Canada (30)(32), China (3), and the United Arab Emirates (2)(1). In 2017, theThe median employee was identified using annual base pay, overtime pay, annual bonus, and target LTI compensation using data as of September 30, 2017. Given that there was no material change to our employee population, the median employee’s compensation programs, or the median employee’s compensation, we are reporting the same employee as first reported in 2018.2020. The annual total compensation for our CEO includes both the amount reported in the “Total” column of theSUMMARY COMPENSATION TABLE of $31,900,878$24,989,374 and the estimated value of our CEO’s health and welfare benefits of $26,203.$27,469. The SEC’s rules for identifying the median compensated employee and calculating the pay ratio based on that employee’s annual total compensation allow companies to adopt a variety of methodologies, to apply certain exclusions, and to make reasonable estimates and assumptions that reflect their employee populations and compensation practices. As a result, the pay ratio reported by other companies may not be comparable to the pay ratio reported above, as other companies have different employee populations and compensation practices and may utilize different methodologies, exclusions, estimates and assumptions in calculating their own pay ratios. 62 PHILLIPS 66 PROXY STATEMENT 2021 | |

NON-EMPLOYEE

DIRECTOR COMPENSATION DIRECTOR COMPENSATION The primary elements of ournon-employee director compensation program are equity compensation and cash compensation, the current levels of which have been in place since January 1, 2016.compensation. OBJECTIVES AND PRINCIPLES Compensation fornon-employee directors is reviewed annually by the Nominating and Governance Committee, with the assistance of such third-party consultants as the Nominating and Governance Committee deems advisable, and set by action of the Board of Directors. The Board’sBoard's goal in designing such compensation is to provide a competitive package that will enable it to attract and retain highly skilled individuals with relevant experience and reflects the time and talent required to serve on the board of a complex, multinational corporation. The Board seeks to provide sufficient flexibility in the form of payment to meet individual needs while ensuring that a substantial portion of director compensation is linked to the long-term success of the Company. In furtherance of our commitment to be a socially responsible member of the communities in which we participate, the Board believes that it is appropriate to extend the Phillips 66 matching gift program to charitable contributions made by individual directors. Equity Compensation In 2019,2020, eachnon-employee director received a grant of RSUs with an aggregate value of $200,000 on the date of grant. Restrictions on the units issued to anon-employee director will lapse in the event of retirement, disability, death, or a change of control, unless the director has elected to receive the underlying shares after a stated period of time. Directors forfeit the units if, prior to the lapse of restrictions, the Board finds sufficient cause for forfeiture (although no such finding can be made after a change in control). Before the restrictions lapse, directors cannot sell or otherwise transfer the units, but the units are credited with dividend equivalents in the form of additional RSUs. When restrictions lapse, directors will receive unrestricted shares of Company stock as settlement of the RSUs. Cash Compensation In 2019,2020, eachnon-employee director received $125,000 in cash compensation for service as a director.Non-employee directors serving in specified committee or leadership positions also received the following additional cash compensation: | | | | LEAD / CHAIR | | | MEMBER | | LEAD / CHAIR | MEMBER | Lead Director | | | $50,000 | | | | N/A | | $50,000 | N/A | Audit and Finance Committee | | | $25,000 | | | | $10,000 | | $25,000 | $10,000 | Human Resources and Compensation Committee | | | $25,000 | | | | $10,000 | | $25,000 | $10,000 | All Other Committees | | | $10,000 | | | | N/A | | $20,000 | N/A |

The total annual cash compensation is payable in monthly cash installments. Directors may elect, on an annual basis, to receive all or part of their cash compensation in unrestricted stock or in RSUs (such unrestricted stock or RSUs are issued on the lastfirst business day of the month valued using the average of the high and low prices of Phillips 66 common stock as reported on the NYSE on such date), or to have the amount credited to the director’sdirector's deferred compensation account as described below. The RSUs issued in lieu of cash compensation are subject to the same restrictions as the annual RSUs described above underEQUITY COMPENSATION. Deferral of Compensation Non-employee directors can elect to defer their cash compensation under the Phillips 66 Deferred Compensation Program fornon-Employee Directors (the “Director Deferral Plan”). Deferred amounts are deemed to be invested in various mutual funds and similar investment choices (including Phillips 66 common stock) selected by the director from a list of investment choices available under the Director Deferral Plan. | PHILLIPS 66 PROXY STATEMENT 2021 63 |

DIRECTOR COMPENSATION The future payment of any compensation deferred bynon-employee directors of Phillips 66 may be funded in a grantor trust designed for this purpose. 2020 PROXY STATEMENT 53

NON-EMPLOYEE DIRECTOR COMPENSATION

Directors’Directors' Matching Gift Program

All active and retirednon-employee directors are eligible to participate in the Directors’Directors' Annual Matching Gift Program. This provides adollar-for-dollar match of gifts of cash or securities, up to a maximum during any one calendar year of $15,000 per donor for active directors and $7,500 per donor for retired directors, to charities and educational institutions (excluding certain religious, political, fraternal, or collegiate athletic organizations) that aretax-exempt under Section 501(c)(3) of the IRC or meet similar requirements under the applicable law of other countries. Amounts representing these matching contributions are contained in the “All Other Compensation” column of theNON-EMPLOYEEDIRECTOR COMPENSATION TABLE. Other Compensation The Board believes that it is important for significant others of directors and executives to attend certain meetings to enhance the collegiality of the Board. The cost of such attendance is treated by the Internal Revenue Service as income and is taxable to the recipient. The Company reimburses directors for the cost of resulting income taxes. Amounts representing this reimbursement are contained in the “All Other Compensation” column of theNON-EMPLOYEEDIRECTOR COMPENSATION TABLE. Stock Ownership Each director is expected to own an amount of Company stock equal to at least the aggregate value of the annual equity grants during their first five years on the Board. Directors are expected to reach this level of target ownership within five years of joining the Board. Actual shares of stock, Restricted Stock, or RSUs, including deferred stock units, may be counted in satisfying the stock ownership guidelines. All current directors are in compliance, or on track to comply, with the guidelines. NON-EMPLOYEEDIRECTOR COMPENSATION TABLE

Phillips 66 benchmarks itsnon-employee director compensation design and pay levels against a group of peer companies. The Company targets the median of this peer group for all elements ofnon-employee director compensation. The following table summarizes the compensation for ournon-employee directors for 20192020 (for compensation paid to our sole employee director, Mr. Garland, please seeEXECUTIVE COMPENSATION TABLES). | NAME | FEES EARNED OR PAID IN CASH

(1) ($) | STOCK AWARDS

(2) ($) | ALL OTHER COMPENSATION (3) ($) | TOTAL

($) | | Gary K. Adams | 135,000 | 200,073 | 15,000 | 350,073 | | Julie L. Bushman (4) | 64,960 | 96,255 | 16,241 | 177,456 | | Lisa A. Davis (4) | 31,210 | 46,253 | — | 77,463 | | J. Brian Ferguson | 87,500 | 200,073 | 4,836 | 292,409 | | Charles M. Holley | 135,000 | 200,073 | 12,498 | 347,571 | | John E. Lowe | 152,917 | 200,073 | 1,515 | 354,505 | | Harold W. McGraw III | 135,000 | 200,073 | — | 335,073 | | Denise L. Ramos | 143,333 | 200,073 | — | 343,406 | | Glenn F. Tilton | 205,000 | 200,073 | 15,870 | 420,943 | | Victoria J. Tschinkel | 135,000 | 200,073 | 20,527 | 355,600 | | Marna C. Whittington | 150,000 | 200,073 | 15,925 | 365,998 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | NAME | | FEES

EARNED

OR PAID

IN CASH(1)

($) | | | STOCK

AWARDS(2)

($) | | | OPTION

AWARDS

($) | | | NON-EQUITY

INCENTIVE PLAN

COMPENSATION

($) | | | CHANGE IN

PENSION

VALUE AND

NONQUALIFIED

DEFERRED

COMPENSATION

EARNINGS

($) | | | ALL OTHER

COMPENSATION(3)

($) | | | TOTAL

($) | | Gary K. Adams | | | 135,000 | | | | 200,059 | | | | — | | | | — | | | | — | | | | 4,004 | | | | 339,063 | | J. Brian Ferguson | | | 150,000 | | | | 200,059 | | | | — | | | | — | | | | — | �� | | | 1,470 | | | | 351,529 | | Charles M. Holley(4) | | | 16,331 | | | | 64,940 | | | | — | | | | — | | | | — | | | | — | | | | 81,271 | | John E. Lowe | | | 145,000 | | | | 200,059 | | | | — | | | | — | | | | — | | | | 14,018 | | | | 359,077 | | Harold W. McGraw III | | | 135,000 | | | | 200,059 | | | | — | | | | — | | | | — | | | | 263 | | | | 335,322 | | Denise L. Ramos | | | 135,000 | | | | 200,059 | | | | — | | | | — | | | | — | | | | 1,782 | | | | 336,841 | | Glenn F. Tilton | | | 195,000 | | | | 200,059 | | | | — | | | | — | | | | — | | | | 17,985 | | | | 413,044 | | Victoria J. Tschinkel | | | 135,051 | | | | 200,059 | | | | — | | | | — | | | | — | | | | 32,617 | | | | 367,727 | | Marna C. Whittington | | | 150,000 | | | | 200,059 | | | | — | | | | — | | | | — | | | | 16,833 | | | | 366,892 | |

(1) | Reflects 2019 base cash compensation of $125,000 payable to each(1) Reflects 2020 base cash compensation of $125,000 payable to each non-employee director. In 2020, non-employee director. In 2019,non-employee directors serving in specified committee positions also received the additional cash compensation described previously. Mr. Holley joined the Board in October 2019 and elected to receive 50% of his prorated 2019 compensation in RSUs. Compensation amounts reflect adjustments related to various changes in committee assignments by Board members throughout the year, if any. Amounts shown include any amounts that were voluntarily deferred to the Director Deferral Plan.

|

54 2020 PROXY STATEMENT

NON-EMPLOYEE DIRECTOR COMPENSATION

(2)64 PHILLIPS 66 PROXY STATEMENT 2021 | Amounts represent the grant date fair market value of RSUs. Under ournon-employee director compensation program,non-employee directors received a 2019 grant of RSUs with an aggregate value of $200,000 on the date of grant, based on the average of the high and low prices for Phillips 66 common stock, as reported on the NYSE, on such date. These grants are made in whole shares with fractional share amounts rounded up, resulting in shares with a value of $200,059 being granted on January 15, 2019 ($48,446 granted on October 4, 2019 for Mr. Holley’spro-rated grant). Mr. Holley elected to receive 50% of his 2019 compensation in RSUs, which is reflected on apro-rata basis as of October 4, 2019, resulting in shares with values of $10,856 granted on November 1, 2019 and $5,638 granted on December 2, 2019.

|

(3) | All Other Compensation is made up primarily of certain gifts by directors to charities and educational institutions (excluding certain religious, political, fraternal, or collegiate athletic organizations) that aretax-exempt under Section 501(c)(3) of the IRC or meet similar requirements under the applicable law of other countries that we match under our Matching Gifts Program (Mr. Lowe $13,000; Mr. Tilton $15,000; Ms. Tschinkel $15,000; and Dr. Whittington $15,000). For active directors, the program matches up to $15,000 with regard to each program year. The amounts shown reflect the actual payments made by us in 2019. All Other Compensation also includes any personal flights, automobile transportation expenses, smaller gifts (such as books, ornaments, and jackets) as well as associated tax protection, and tax assistance when we request family members or other guests to accompany a director to a Company function and, as a result, the director is deemed to make personal use of Company assets such as Company aircraft and thereby incurs imputed income.

|

(4) | Amounts shown represent compensation paid to Mr. Holley following his election to the Board in October 2019.

|

2020 PROXY STATEMENT 55

DIRECTOR COMPENSATION Compensation amounts reflect adjustments related to various changes in committee assignments by Board members throughout the year, if any. Amounts shown include any amounts that were voluntarily deferred to the Director Deferral Plan. (2) Amounts represent the grant date fair market value of RSUs. Under our non-employee director compensation program, non-employee directors received a 2020 grant of RSUs with an aggregate value of $200,000 on the date of grant, based on the average of the high and low prices for Phillips 66 common stock, as reported on the NYSE, on such date. These grants are made in whole shares with fractional share amounts rounded up, resulting in shares with a value of $200,073 being granted on January 15, 2020 ($96,255 granted on July 8, 2020 for Ms. Bushman's pro-rated grant and $46,253 granted on October 8, 2020 for Ms. Davis’ pro-rated grant). (3) All Other Compensation is made up primarily of certain gifts by directors to charities and educational institutions (excluding certain religious, political, fraternal, or collegiate athletic organizations) that are tax-exempt under Section 501(c)(3) of the IRC or meet similar requirements under the applicable law of other countries that we match under our Matching Gifts Program (Mr. Adams $15,000; Ms. Bushman $15,000; Mr. Holley $10,000; Ms. Tschinkel $15,000; and Dr. Whittington $15,000). For active directors, the program matches up to $15,000 with regard to each program year. The amounts shown reflect the actual payments made by us in 2020. All Other Compensation also includes any personal flights, automobile transportation expenses, smaller gifts (such as books, ornaments, and jackets) as well as associated tax protection, and tax assistance when we request family members or other guests to accompany a director to a Company function and, as a result, the director is deemed to make personal use of Company assets such as Company aircraft and thereby incurs imputed income. (4) Amounts shown represent compensation paid to Ms. Bushman and Ms. Davis following election to the Board in July 2020 and October 2020, respectively.

EQUITY COMPENSATION PLAN INFORMATION The following table sets forth information about Phillips 66 common stock that may be issued under all existing equity compensation plans as of December 31, 2019:2020: | PLAN CATEGORY | NUMBER OF SECURITIES

TO BE ISSUED UPON

EXERCISE OF

OUTSTANDING OPTIONS,

WARRANTS AND RIGHTS (1,2) | WEIGHTED-AVERAGE

EXERCISE PRICE OF

OUTSTANDING OPTIONS,

WARRANTS AND

RIGHTS(3) | NUMBER OF SECURITIES

REMAINING

AVAILABLE FOR FUTURE ISSUANCE

UNDER EQUITY COMPENSATION

PLANS (EXCLUDING SECURITIES

REFLECTED IN COLUMN (a) (4) | | Equity compensation plans approved by security holders | 9,700,131 | 78.49 | 29,010,540 | | Equity compensation plans not approved by security holders | | | | | Total | 9,700,131 | 78.49 | 29,010,540 |

| | | | | | | | | | | | | PLAN CATEGORY | | NUMBER OF SECURITIES TO BE

ISSUED UPON EXERCISE OF

OUTSTANDING OPTIONS, WARRANTS AND RIGHTS(1,2) (a) | | | WEIGHTED-AVERAGE EXERCISE PRICE OF OUTSTANDING OPTIONS, WARRANTS AND RIGHTS(3) (b) | | | NUMBER OF SECURITIES REMAINING AVAILABLE FOR FUTURE ISSUANCE UNDER

EQUITY COMPENSATION PLANS (EXCLUDING

SECURITIES REFLECTED IN COLUMN (a))(4) (c) | | Equity compensation plans approved by security holders | | | 9,111,577 | | | | 72.55 | | | | 31,117,414 | | Equity compensation plans not approved by security holders | | | | | | | | | | | | | Total | | | 9,111,577 | | | | 72.55 | | | | 31,117,414 | |

(1) | (1) | Includes awards issued under the Omnibus Stock and Performance Incentive Plan of Phillips 66 and awards issued under the 2013 Omnibus Stock and Performance Incentive Plan of Phillips 66. |

(2) | (2) | Includes an aggregate of 4,779,4045,433,988 Incentive Stock Options and Nonqualified Stock Options issued to employees, 6,0824,093 Restricted Stock Awards granted under historical LTI plans, and 1,460,157959,768 PSUs. The number of securities to be issued includes 2,865,9343,302,282 RSUs, of which 177,397199,315 were issued tonon-employee directors. Some awards held by ConocoPhillips employees at ourspin-off were adjusted or substituted with a combination of ConocoPhillips and Phillips 66 equity. Awards representing a total of 13,071,435 shares were issued to ConocoPhillips employees, of which 2,137,9441,389,126 remain outstanding as of December 31, 2019.2020. The awards issued to ConocoPhillips employees are included in the outstanding awards listed above. |

(3) | (3) | The weighted-average exercise price reflects the weighted-average price for outstanding Incentive Stock Options and Nonqualified Stock Options only. It does not include stock awards outstanding. |

(4) | (4) | Total includes forfeited shares under the Omnibus Stock and Performance Incentive Plan of Phillips 66 that are now available for grant under the 2013 Omnibus Stock and Performance Incentive Plan of Phillips 66. |

| PHILLIPS 66 PROXY STATEMENT 2021 65 |

SHAREHOLDER PROPOSALS HOLDINGS OF MAJOR SHAREHOLDERSSHAREHOLDER PROPOSALS

We communicate proactively and transparently on issues of interest to the Company and our shareholders, including the topics presented in the shareholder proposals on the following pages. You can read more about our engagement with our shareholders under the CORPORATE RESPONSIBILITY section of this Proxy Statement. As discussed in that section, we communicate with shareholders throughout the year to gather feedback and enhance our disclosures or other practices on an ongoing basis. When we receive shareholder proposals, our process includes contacting the proponent to discuss the proposal, the concerns raised, and whether additional engagements could resolve the proponent’s concerns. This engagement seeks to understand the proponent’s interests and how the Company can address or alleviate concerns raised in the proposal, either by discussion of actions and efforts the Company has planned or underway, or by providing information of which the proponent may not be aware. We followed our normal practice of engagement with the proponents of the proposals included on the following pages. The following table sets forth information regarding persons who we know toare shareholder proposals that will be voted on at the beneficial owners of more than five percent of our issued and outstanding common stock as of March 11, 2020, based on a review of publicly available statements of beneficial ownership filed with the SEC: | | | | | | | | | | | | COMMON STOCK | | NAME AND ADDRESS | | NUMBER OF SHARES | | | PERCENT OF CLASS | | The Vanguard Group(1) 100 Vanguard Blvd. Malvern, PA 19335 | | | 38,321,650 | | �� | | 8.75 | % | State Street Corporation(2) One Lincoln Street Boston, MA 02111 | | | 22,688,552 | | | | 5.18 | % | BlackRock, Inc.(3) 55 East 52nd Street New York, NY 10055 | | | 30,410,948 | | | | 6.94 | % |

(1) | Based solely on an Amendment to Schedule 13G filed with the SEC on February 12, 2020, by The Vanguard Group on behalf of itself, Vanguard Fiduciary Trust Company, and Vanguard Investments Australia, Ltd. The Amendment to Schedule 13G reports sole voting power for 664,641 shares of common stock, shared voting power for 132,317 shares of common stock, sole dispositive power for 37,567,079 shares of common stock and shared dispositive power for 754,571 shares of common stock.

|

(2) | Based solely on a Schedule 13G filed with the SEC on February 13, 2020, by State Street Corporation on behalf of itself, State Street Bank And Trust Company, SSGA Funds Management, Inc, State Street Global Advisors Limited (UK), State Street Global Advisors Ltd (Canada), State Street Global Advisors, Australia Limited, State Street Global Advisors (Japan) Co., Ltd, State Street Global Advisors Asia Ltd, State Street Global Advisors Singapore Ltd, State Street Global Advisors GmbH, State Street Global Advisors Ireland Limited, and State Street Global Advisors Trust Company. The Schedule 13G reports sole voting power for no shares of common stock, shared voting power for 20,500,940 shares of common stock, sole dispositive power for no shares of common stock and shared dispositive power for 22,642,663 shares of common stock.

|

(3) | Based solely on an Amendment to Schedule 13G filed with the SEC on February 5, 2020, by BlackRock, Inc. on behalf of itself, BlackRock Advisors, LLC, BlackRock Financial Management, Inc., BlackRock Investment Management, LLC, BlackRock Investment Management (Australia) Limited, BlackRock Investment Management (UK) Limited, BlackRock (Luxembourg) S.A., BlackRock (Netherlands) B.V., BlackRock Fund Managers Ltd, BlackRock Life Limited, BlackRock Asset Management Canada Limited, BlackRock Asset Management Ireland Limited, BlackRock Asset Management Schweiz AG, BlackRock (Singapore) Limited, BlackRock Advisors (UK) Limited, BlackRock Fund Advisors, BlackRock International Limited, BlackRock Institutional Trust Company, National Association, BlackRock Japan Co. Ltd., BlackRock Asset Management Canada Limited, FutureAdvisor, Inc., and BlackRock Asset Management North Asia Limited. The Amendment to Schedule 13G reports sole voting power for 25,482,410 shares of common stock, no shared voting power for shares of common stock, sole dispositive power for 30,410,948 shares of common stock and no shared dispositive power for shares of common stock.

|

56 2020 PROXY STATEMENT

SECURITIES OWNERSHIP OF OFFICERS AND DIRECTORS

SECURITIES OWNERSHIP OF OFFICERS AND DIRECTORS

The following table sets forth the number of shares of our common stock beneficially owned as of March 11, 2020,Annual Meeting only if properly presented by each Phillips 66 director, by each NEO and by all of our directors and executive officers as a group. Together these individuals beneficially own less than one percent of our common stock. The table also includes information about stock options, restricted stock, RSUs and deferred stock units credited to the accounts of our directors and executive officers under various compensation and benefit plans. For purposes of this table, shares are considered to be “beneficially” owned if the person, directly or indirectly, has sole or shared voting or investment power with respect to such shares. In addition, a person is deemed to beneficially own shares if that person has the right to acquire such shares within 60 days of March 11, 2020.

| | | | | | | | | | | | | | | | NUMBER OF SHARES OR UNITS | | NAME OF BENEFICIAL OWNER | | TOTAL COMMON STOCK BENEFICIALLY OWNED | | | RESTRICTED/ DEFERRED STOCK UNITS(1) | | | OPTIONS EXERCISABLE WITHIN 60 DAYS(2) | | Mr. Garland | | | 512,643 | | | | 100,094 | | | | 932,466 | | Mr. Herman | | | 35,763 | | | | 69,528 | | | | 134,533 | | Ms. Johnson | | | 72,668 | | | | 22,945 | | | | 155,899 | | Mr. Mitchell | | | 42,755 | | | | 33,525 | | | | 119,232 | | Mr. Roberts | | | 7,645 | | | | 22,864 | | | | 86,866 | | Mr. Adams | | | 8,963 | | | | — | | | | — | | Mr. Ferguson(3) | | | 21,734 | | | | 26,202 | | | | — | | Mr. Holley | | | — | | | | 2,536 | | | | — | | Mr. Lowe | | | 35,000 | | | | 26,202 | | | | — | | Mr. McGraw(4) | | | 873 | | | | 46,798 | | | | — | | Ms. Ramos | | | — | | | | 9,485 | | | | — | | Mr. Tilton | | | 5,900 | | | | 26,202 | | | | — | | Ms. Tschinkel(5) | | | 48,974 | | | | 8,834 | | | | — | | Dr. Whittington | | | 2,500 | | | | 26,202 | | | | — | | Directors and Executive Officers as a Group (16 Persons) | | | 816,056 | | | | 451,472 | | | | 1,503,795 | |

(1) | Includes RSUs or deferred stock units that may be voted or sold only upon passage of time.

|

(2) | Includes beneficial ownership of shares of common stock which may be acquired within 60 days of March 11, 2020, through stock options awarded under compensation plans.

|

(3) | Includes 21,500 shares of common stock owned by an entity managed by Mr. Ferguson and his wife.

|

(4) | Includes 373 shares held on behalf of the Harold W. McGraw Family Foundation, Inc., of which Mr. McGraw serves on the board, or various trusts for the benefit of various family members of Mr. McGraw and for which trusts Mr. McGraw serves as trustee and has voting and investment power. Mr. McGraw disclaims beneficial ownership of all securities held by the foundation and the trusts.

|

(5) | Includes 171 shares of common stock owned by the Erika Tschinkel Trust.

|

2020 PROXY STATEMENT 57

PROPOSAL 4:REPORT ON RISKS OF GULF COAST PETROCHEMICAL INVESTMENTS

As You Sow, on behalf of Amy Devinethe shareholder proponent. These proposals contain certain assertions that we believe are incorrect, and Douglas Triggs, ownerswe have not attempted to refute all of 27 sharesthe inaccuracies.

The proposals we received relate to environmental, sustainability, or governance issues, and request that we take particular action, which may include preparing a report. We share some of the concerns addressed in the proposals, and we have taken actions that we believe address many of the underlying concerns of the proposals. However, we disagree with how the proposal seeks to prescribe the manner in which we approach or report on the issue. The Board generally opposes proposals requesting specially developed reports or initiatives as they do not necessarily reflect the actions we are already taking to address such issues, the decisions we have made in prioritizing our initiatives, or the unique and evolving nature of our operations. Additionally, producing special reports is often not a good use of our resources when the issues are addressed through existing communications. Moreover, we believe that shareholders benefit from reading about these issues in the context of Phillips 66 common stock,66’s other activities rather than in isolation. Many of the issues raised in the following proposals are already discussed in our Sustainability Report, our Annual Report on Form 10-K, this Proxy Statement and other information on our website at www.phillips66.com. We encourage you to read this Proxy Statement, our Annual Report on Form 10-K, our Sustainability Report and the Rita K. Devine Irrevocable Trust, owner of 20 shares of Phillips 66 common stock, notified us that they intend to submit the following proposal at this year’s Annual Meeting. other information presented on our website. We will furnishpromptly provide each shareholder proponent’s name, address, and, to our knowledge, share ownership upon a shareholder’s request. 66 PHILLIPS 66 PROXY STATEMENT 2021 | |

SHAREHOLDER PROPOSALS PROPOSAL 5: SHAREHOLDER PROPOSAL REGARDING GHG EMISSIONS TARGETS WHEREAS: We, the addressshareholders, must protect our assets against devastating climate change, and therefore support companies to substantially reduce greenhouse gas (GHG) emissions. RESOLVED: Shareholders request the Company to set and publish emissions reduction targets covering the greenhouse gas (GHG) emissions of the proponents upon request. In accordance with federal securities regulations, weCompany’s operations and energy products. You have included the textour support. SUPPORTING STATEMENT: The policies of the proposalenergy industry are crucial to curbing climate change. Therefore, shareholders support oil and supporting statement exactly as submitted bygas companies to change course; to substantially reduce emissions and invest accordingly in the proponent. Weenergy transition. Fiduciary duty As shareholders, we understand this support to be part of our fiduciary duty to protect all assets in the global economy from devastating climate change. A growing international consensus has emerged among financial institutions that climate-related risks are nota source of financial risk, and therefore limiting global warming is essential to risk management and responsible for the contentstewardship of the proposal or any inaccuracies it may contain.economy. As explained below, your Board recommends that you vote “AGAINSTWe therefore support the company to set emissions reduction targets for all emissions: the emissions of the company’s operations and the emissions of its energy products (Scope 1, 2, and 3). ” this shareholder proposal.Reducing emissions from the use of energy products (Scope 3) is essential to limiting global warming.

“RESOLVED: Increasing number of investors insists on targets for all emissions

Shell, BP, Equinor, and Total have already adopted Scope 3 ambitions. Backing from investors that insist on targets for all emissions continues to gain momentum; in 2020, an unprecedented number of shareholders voted for climate targets resolutions. It is evident that a growing group of investors across the energy sector unites behind visible and unambiguous support for targets for all emissions. Shareholders request that Phillips 66, with board oversight, publish athe company report omitting proprietary informationon the strategy and preparedunderlying policies for reaching these targets and on the progress made, at least on an annual basis, at reasonable cost assessingand omitting proprietary information. Nothing in this resolution shall limit the public health risks of expanding petrochemical operationscompany’s powers to set and investmentsvary their strategy or take any action which they believe in areas increasingly pronegood faith would best contribute to climate change-induced storms, flooding, and sea level rise.reaching these targets. Supporting Statement: Investors requestWe believe that the company assess, among other related issues at managementcould lead and Board discretion: The adequacy of measures the company is employing to prevent public health impacts from associated chemical releases.

WHEREAS: Investors are concerned about the financial, health, environmental, and reputational risks associated with operating andbuilding-out new chemical plants and related infrastructure in Gulf Coast locations increasingly prone to catastrophic storms and flooding associated with climate change. Chevron Phillips Chemical Company (CPChem), owned jointly by Phillips 66 and Chevron, is a major petrochemical producerthrive in the Gulf Coast.

Petrochemical facilities like ethane crackers and polyethylene processing plants produce dangerous pollutants including benzene (a known carcinogen), Volatile Organic Compounds, and sulfur dioxide. These operations can become inundated and pose severe chemical release risks during extreme weather events. Flooding from Hurricane Harvey in 2017 resulted in CPChem plant shut downsenergy transition. We therefore encourage you to set targets that are inspirational for society, employees, shareholders, and the release of unpermitted, unsafe levels of pollutants. Nearby Houston residents reported respiratory and skin problems following CPChem’s releases during Hurricane Harvey.

Growing storms and the costs they bring our company are predicted to increase in frequency and intensity as global warming escalates. Recent reports show that greenhouse gas emissions throughout the petrochemical and plastic supply chain contribute significantly to climate change, exacerbating the threat of physical risks such as storms. Flood-related damage is projected to be highest in Texas, where many of CPChem’s petrochemical plants are concentrated, and Houston alone has seen three500-year floods in a three-year span. Phillips 66 cited Hurricane Harvey as a major reason for a $123 million decrease inpre-tax income from its chemicals segment in 2017.

Civil society groups have mobilized to oppose the expansion of petrochemical facilities in their communities due to concerns regarding direct health and livelihood impacts from air and water pollutant releases. Such opposition threatens to jeopardize CPChem’s social license to operate in the region. Historically, releases from CPChem’s petrochemical operations have exceeded legal limits, exposingenergy sector, allowing the company to liability. Asmeet an increasing demand for energy while reducing GHG emissions to levels consistent with the curbing climate change intensifies flooding and storm strength, the potential for unplanned chemical releases grows.change.